Introducing ANZ bank

1hr → 10 min

Loan application cut from 1hr → 10min

13 → 1 system

Replaced 13 legacy systems with 1

Omni-channel

Seamless multi-branch, multi-channel banking experience

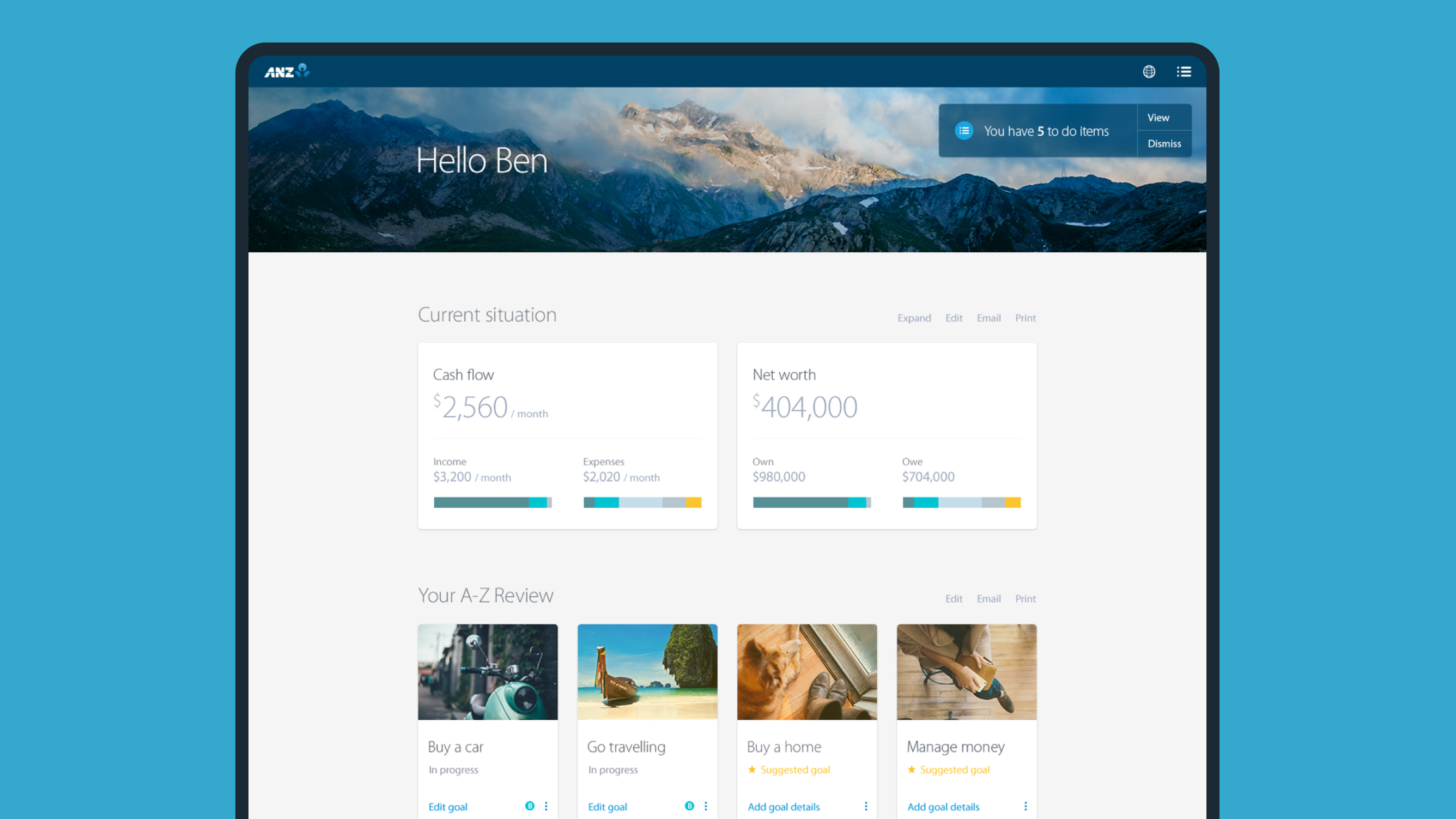

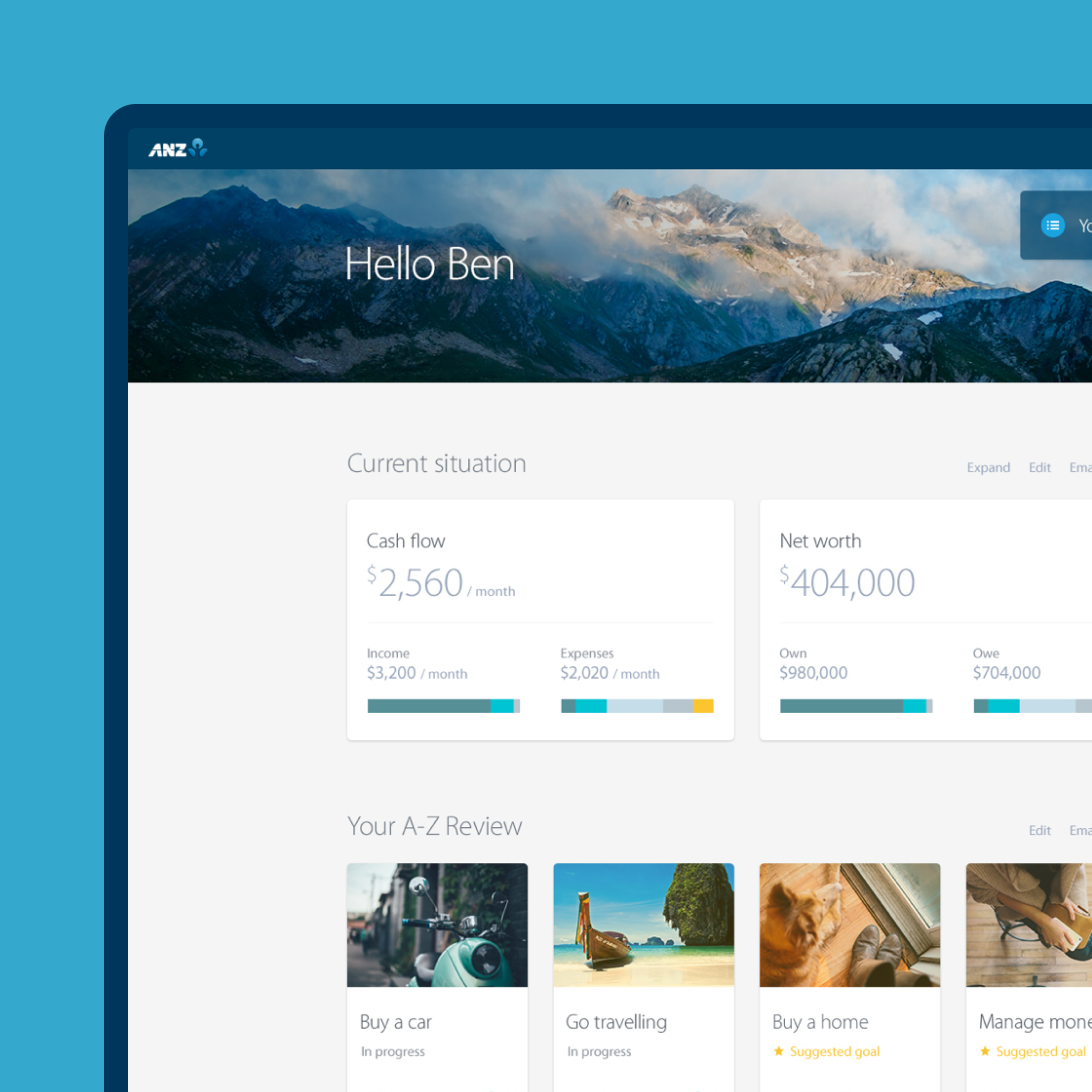

To simplify the banking experience we created Banker Desktop, a unified shared screen experience that allows customers to take charge of their financial health.

Helping customers take charge of their financial health

We crafted a model that represents the often fragmented and nonlinear nature of conversations between the customer and banker allowing a seamless and transparent banking experience. ANZ Banker Desktop gives customers the ability to visit multiple branches across multiple channels, whilst maintaining a consistent and speedy banking experience.

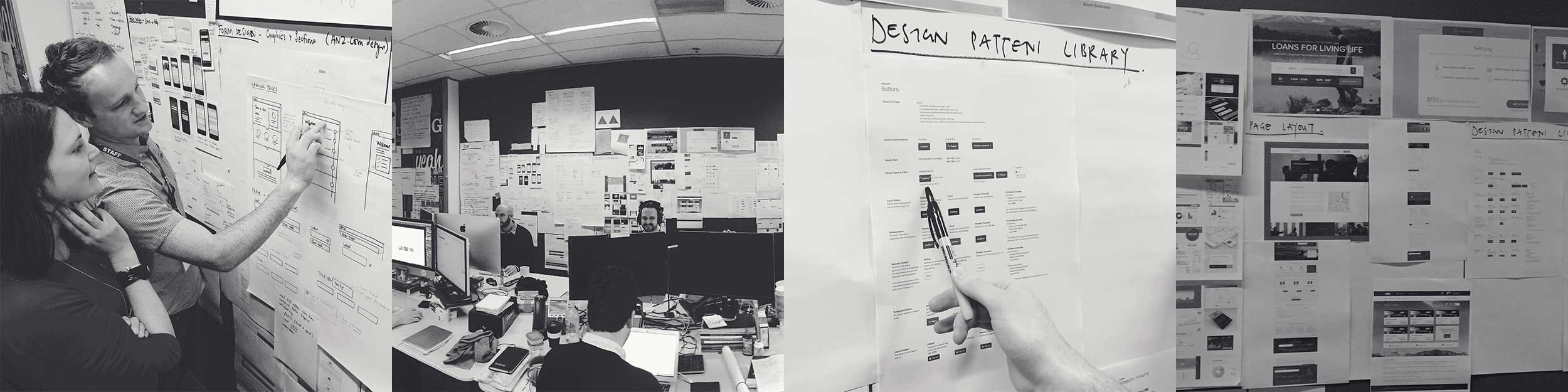

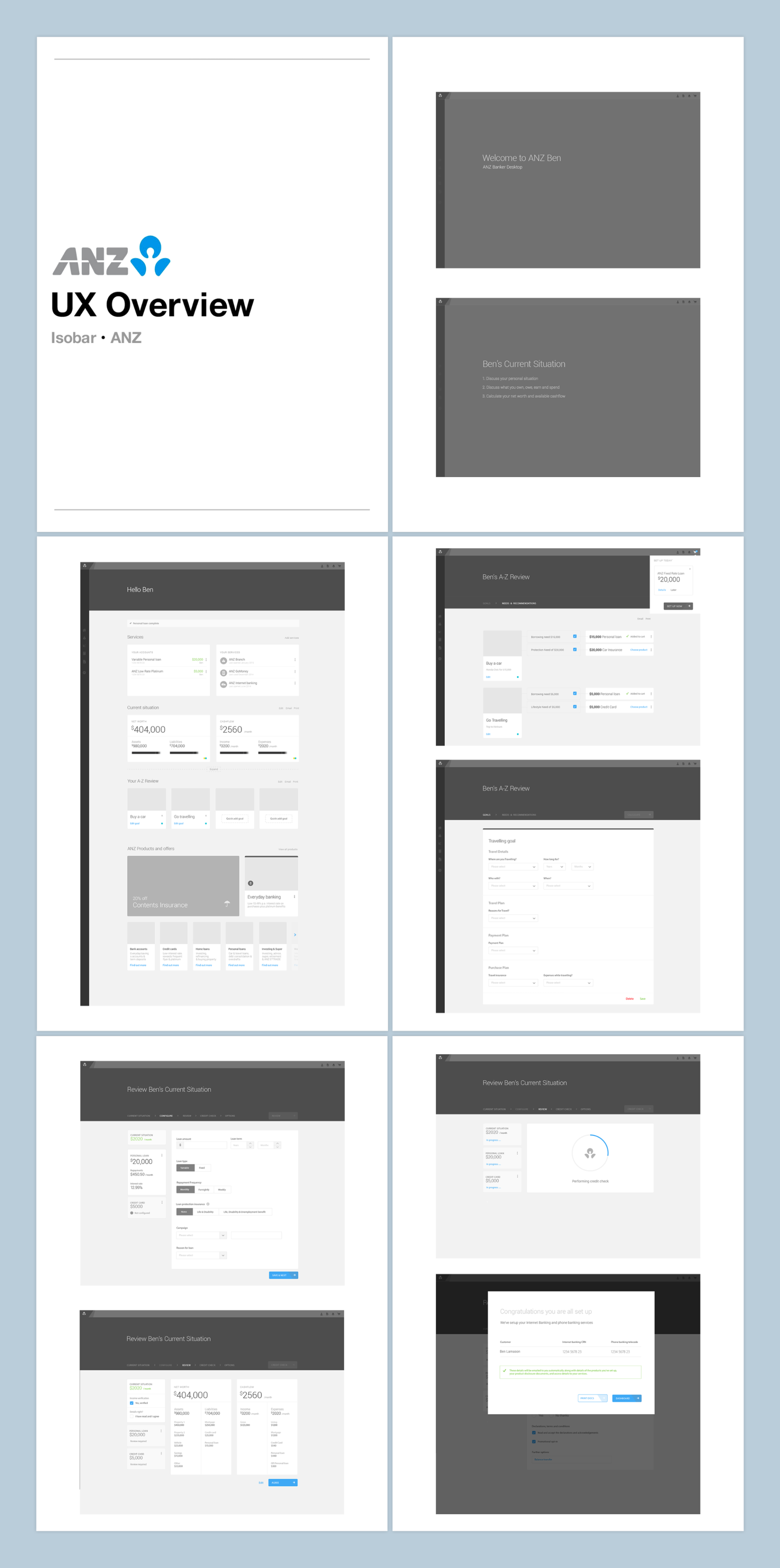

Wireframe & Testing process

We used whiteframes, prototypes and then hi fidelity wireframes to create and improve ideas. Fortnightly testing panels enabled us to quickly find out which ideas were good and which ideas really needed improvement.

The Results

- We were able to reduce the loan application time from 1hr to 10min.

- Replacing 13 complex systems with 1

- Customers can now visit multiple branches across multiple channels, whilst maintaining a consistent and speedy banking experience

“Working with Dave was a joy. He’s a thoughtful, empathetic designer who truly cares about client and customer needs, and his positive, smiling presence always lifted the team.”

Lauren Skogstad

Associate design director

at Isobar Australia

Let’s do great work together

Need a confident design leader who can guide teams, influence execs, and jump into Figma? I’m your guy, let’s talk.

Email me

View my LinkedIn